Unified KYC for a Regulated, Global World

ZOOP Smart KYC consolidates multiple verification rails into one API layer , enabling faster onboarding, seamless compliance, and resilient performance at scale.

By The Numbers

96.78%

KYC Success Rate

<2s

Response Time

5+

KYC Sources

14K+

Documents Supported

Components Powering Smart Digital Onboarding

A unified suite of intelligent solutions that work together to deliver secure, compliant, and seamless identity verification.

Smart KYC Orchestration

Orchestrate every verification source through one intelligent layer.

Intelligent auto-switching engine

Multi-source verification orchestration

Rule-based decisioning & fallback logic

Standardized KYC data output

Face Verification Suite

Advanced biometric verification designed to detect, verify, and prevent fraud.

Passive face liveness detection

High-accuracy face matching

Face search & deduplication

Deepfake & spoofing defense

Contract Signing

Digitize every agreement, signature, and consent , securely and compliantly.

eStamps & digital signatures

Dynamic document templates

Audit trails & tracking

Regulatory compliance controls

How Our Compliant Smart KYC Works?

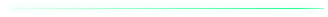

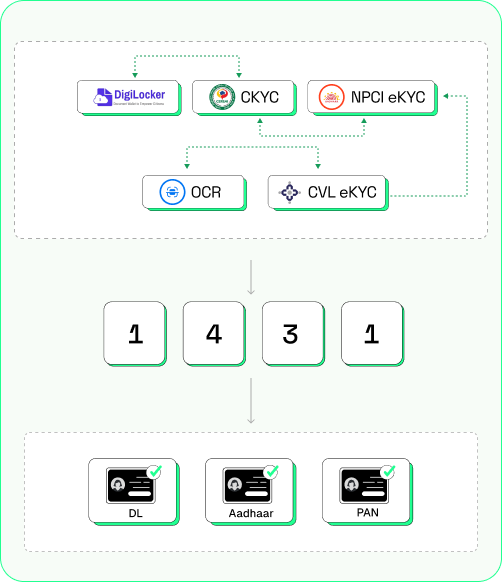

Intelligent Source Selection

Our orchestration engine auto-selects the best KYC source based on uptime and latency, with instant fallback if one fails.

- DigiLocker / CKYC / CVL eKYC / NPCI eKYC / OCR supported

- OTP authentication only where required

- Real-time document & identity data retrieval

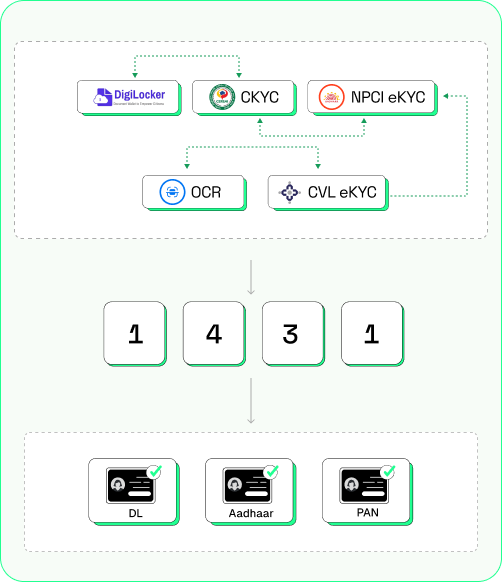

Identity & Liveness Verification

Using ZOOP's Face Liveness SDK and matching algorithms, we ensure genuine user presence and identity consistency.

- Active & passive spoof detection

- Live-photo vs source-photo match

- PAN & ID validation

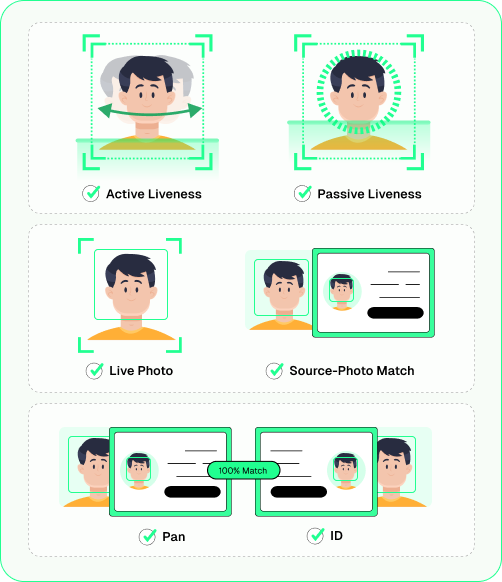

Compliance & Standardization

All data is normalized into a unified, audit-ready KYC record.

- Standardized data schema across all sources

- Automatic consent + activity logging

- Optional AML / PEP screening

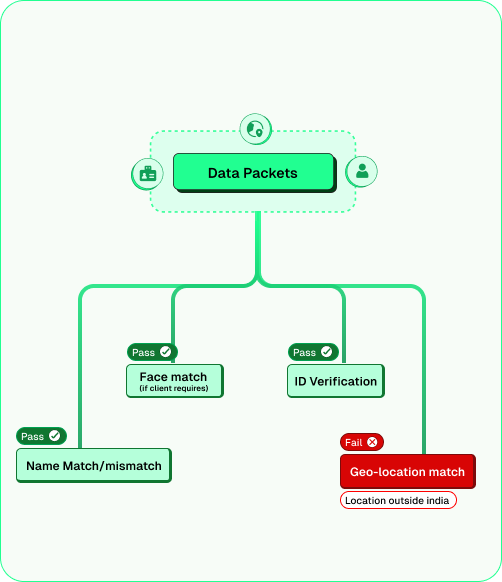

Decisioning & Delivery

A complete KYC decision package is generated and delivered via secure webhook.

- Pass / Refer / Fail with reason codes

- Watermarked artifacts (CAF ID, geo-tag, agent ID if needed)

- Ready for direct LOS / CRM integration

Intelligent Source Selection

Our orchestration engine auto-selects the best KYC source based on uptime and latency, with instant fallback if one fails.

- DigiLocker / CKYC / CVL eKYC / NPCI eKYC / OCR supported

- OTP authentication only where required

- Real-time document & identity data retrieval

Identity & Liveness Verification

Using ZOOP's Face Liveness SDK and matching algorithms, we ensure genuine user presence and identity consistency.

- Active & passive spoof detection

- Live-photo vs source-photo match

- PAN & ID validation

Compliance & Standardization

All data is normalized into a unified, audit-ready KYC record.

- Standardized data schema across all sources

- Automatic consent + activity logging

- Optional AML / PEP screening

Decisioning & Delivery

A complete KYC decision package is generated and delivered via secure webhook.

- Pass / Refer / Fail with reason codes

- Watermarked artifacts (CAF ID, geo-tag, agent ID if needed)

- Ready for direct LOS / CRM integration

Why Choose Smart KYC

Auto-Switching Engine

Smart KYC intelligently routes every request to the best-performing source, automatically switching between multiple sources.

Multi-Source KYC Stack

Power your onboarding with a unified stack that connects all verification rails: DigiLocker, CKYC, CVL eKYC Setu, NPCI eKYC Setu, & more.

Standardized & Traceable Data

Smart KYC delivers normalized, audit-traceable KYC data with full consent and field mapping, ready for seamless ingestion into your CRM or LOS.

Fully Compliant Architecture

Pre-aligned with RBI, SEBI, IRDAI and UIDAI frameworks and covering consent, data storage, and audit requirements, so your onboarding stays future-proof and regulator-ready.

Industries We Power

Banking & Financial Services

Orchestrate complex verification flows across multiple sources , without losing speed or compliance. ZOOP ensures instant identity validation and consistent pass rates for high-volume retail and corporate onboarding.

Lending & Credit

Handle high-scale, high-risk onboarding with intelligent fallback and unified compliance logic. From CKYC to DigiLocker, every source is orchestrated to deliver faster approvals and lower rejection rates.

Insurance

Authenticate policyholders and claimants in seconds with verified, traceable data. ZOOP Smart KYC combines face verification, consent records, and source-matched documents to keep fraud out of your claims flow.

Fintech & Payments

Build trust without friction. Smart KYC simplifies app-based onboarding with lightweight SDKs, auto-switching logic, and standardized KYC data ready for instant activation.

Telecom & Mobility

Onboard users, drivers, or agents remotely with complete regulatory assurance. ZOOP enables seamless journeys with liveness, geo-tagging, and audit-ready data delivery.

Enterprise & B2B Platforms

Unify complex business verification in one flow. Smart KYC handles KYB, director validation, and document checks through one orchestrated compliance layer , saving time, effort, and regulatory overhead.